How Economic Indicators Affect Industrial Real Estate Decisions

Introduction

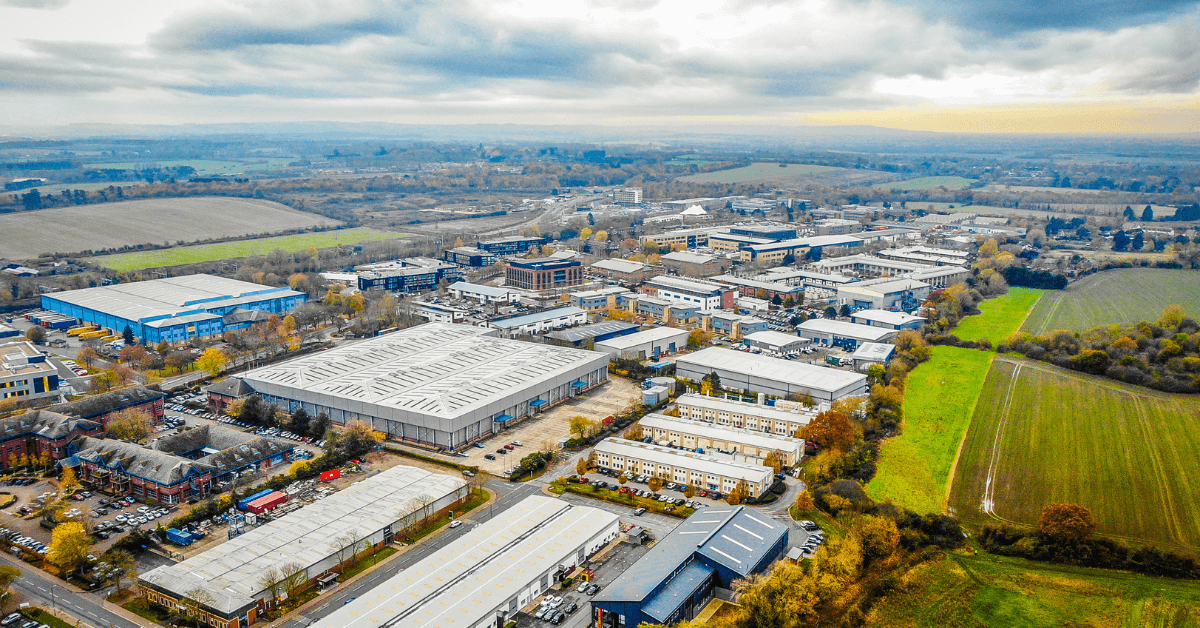

In the world of industrial real estate, decisions are rarely made in isolation. Broader economic trends, from inflation rates to GDP growth, play a pivotal role in shaping market dynamics. Understanding how economic indicators affect industrial real estate can provide valuable insights for investors, corporate tenants, and property owners. These indicators offer a glimpse into the health of the economy and its impact on leasing demand, property values, and investment opportunities.

This blog explores the relationship between economic indicators and industrial real estate, highlighting the key metrics that influence decision-making. Whether you’re expanding your portfolio or securing a lease, understanding these trends is crucial for making informed and strategic decisions.

GDP Growth and Industrial Demand

Gross Domestic Product (GDP) growth is one of the most critical indicators influencing industrial real estate. A growing GDP typically signals a healthy economy, increased production, and rising consumer demand. These factors drive the need for industrial properties such as warehouses, manufacturing facilities, and distribution centers. For instance, a surge in consumer spending often leads to higher demand for logistics and storage spaces to support supply chains.

Conversely, during periods of economic contraction, GDP decline can result in reduced demand for industrial properties as businesses scale back operations. Investors and corporate tenants must closely monitor GDP trends to anticipate shifts in leasing activity and market conditions. Aligning industrial real estate decisions with GDP growth ensures that businesses remain agile and prepared to capitalize on emerging opportunities.

Inflation and Lease Costs

Inflation directly impacts the cost of leasing and owning industrial properties. Rising inflation often leads to higher construction costs, property values, and rent escalations, making it more expensive for businesses to lease industrial space. For property owners, inflation can increase operational expenses, such as maintenance and utilities, which are often passed on to tenants through triple-net leases.

Understanding inflation trends allows both investors and tenants to prepare for potential cost increases. Tenants might consider negotiating long-term leases with fixed rent increases to hedge against inflation, while investors can focus on properties in high-demand areas where they can maintain pricing power. Navigating inflation effectively ensures that industrial real estate decisions align with financial goals and market realities.

Interest Rates and Financing Industrial Properties

Interest rates are another vital economic indicator affecting industrial real estate decisions. When interest rates are low, borrowing costs decrease, making it easier for investors to finance property acquisitions or development projects. This often leads to increased activity in the industrial market, with investors leveraging favorable rates to expand their portfolios.

However, rising interest rates can have the opposite effect, increasing financing costs and cooling down the market. Higher interest rates may also discourage tenants from pursuing long-term leases as operational costs rise. Monitoring interest rate trends helps both investors and tenants make timely decisions, such as securing financing before rates increase or locking in lease agreements during favorable conditions.

Employment Trends and Labor Access

Employment trends play a crucial role in determining the viability of industrial real estate locations. High employment rates often correlate with increased production and consumer spending, which can drive demand for industrial properties. However, businesses must also consider the availability of a skilled workforce in the area. For example, a manufacturing facility located far from labor markets may struggle to attract employees, impacting operations and productivity.

Conversely, regions with robust labor markets and infrastructure often see higher demand for industrial spaces. Investors and corporate tenants should evaluate employment trends alongside other economic indicators to choose locations that align with their business needs. Proximity to labor markets ensures operational efficiency and long-term sustainability.

Conclusion

Understanding how economic indicators affect industrial real estate is essential for navigating this dynamic market. From GDP growth and inflation to interest rates and employment trends, these metrics provide valuable insights into leasing demand, investment opportunities, and market conditions. Aligning industrial real estate decisions with economic trends allows investors and corporate tenants to stay ahead of market shifts and make strategic, informed choices.

We hope this guide has provided clarity on the intersection of economic indicators and industrial real estate. If you have questions or would like personalized advice for your next lease or investment, leave a comment below or reach out to us directly. At JDM Partners, we’re here to help you navigate the complexities of industrial real estate with confidence and expertise.